Post Office FD Scheme: For most people, savings feel incomplete without a Fixed Deposit (FD). It’s one of the oldest and safest ways to grow money, and when it comes with the trust of the Post Office, families feel even more secure. Unlike risky investments, a Post Office FD doesn’t swing up and down it simply grows quietly in the background. Now let’s take a real example. If you invest ₹7 lakh in a Post Office FD, after the full tenure your maturity amount becomes around ₹10,14,964. That’s a gain of over ₹3 lakh, without any stress. Let’s look closely at how this works.

How Post Office FD Works

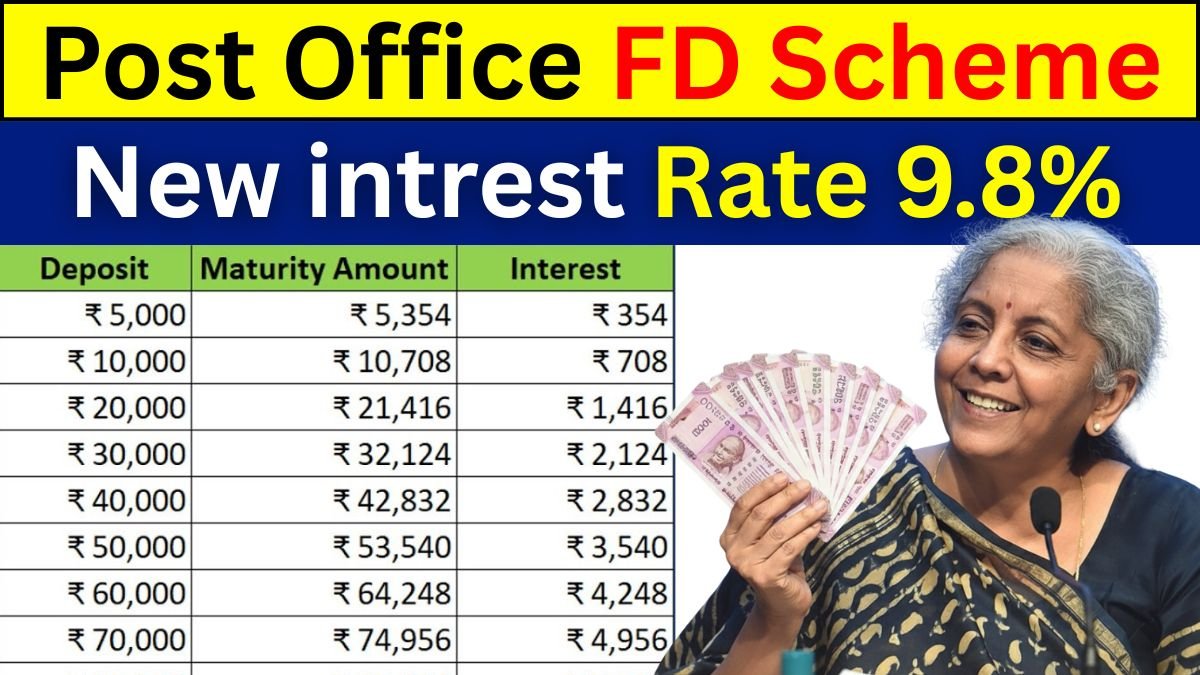

A Fixed Deposit is like a silent agreement with the bank or post office. You deposit a fixed sum for a fixed number of years, and in return, you receive guaranteed interest. The Post Office currently offers an interest rate of 7.5% per annum (compounded quarterly) for a 5-year FD. This quarterly compounding makes a big difference, because not only your deposit but also the interest keeps earning more interest every three months.

Read more: Deposit ₹15,000 and Get ₹10,70,492 Return After 5 Years

Exact Calculation of ₹7 Lakh FD

| Deposit Amount | Tenure | Interest Rate | Maturity Amount | Total Interest Earned |

|---|---|---|---|---|

| ₹7,00,000 | 5 Years | 7.5% (Quarterly Compounded) | ₹10,14,964 | ₹3,14,964 |

So, while you keep your ₹7 lakh safely parked, after 5 years you receive a neat total of ₹10.14 lakh. That extra ₹3.14 lakh is the reward for patience and choosing a safe government-backed plan.

Why Families Prefer Post Office FD

FDs are popular because they give certainty. Parents saving for children’s education, young couples planning for a home, or retired individuals wanting secure returns all find comfort in this scheme. Unlike shares or mutual funds where risk is always there, an FD promises exactly what you will get on maturity. Think of it like storing grain in a government warehouse. You know that when you come back after a few years, the grain hasn’t just stayed safe it’s increased in quantity too. That’s the power of compounding in an FD.

Conclusion

The Post Office FD scheme is a dependable way to grow your savings steadily. By investing ₹7 lakh, you can receive ₹10,14,964 at the end of 5 years. It’s safe, simple, and perfect for anyone who values guaranteed returns without risk.

Disclaimer

This article is only for educational and general knowledge purposes. Interest rates in Post Office FD can change as per government updates. Please verify the latest details from official India Post sources or consult a financial advisor before investing.