Post Office RD Scheme: Most of us think that building a big fund requires a big one-time investment. But the truth is small and regular contributions can create something equally powerful. That’s exactly what the Post Office Recurring Deposit (RD) Scheme proves. With discipline and patience, your savings multiply without any risk. Now imagine this if you save ₹15,000 every month in just five years you’ll have a maturity value of nearly ₹10,70,492. Sounds like a smart move right? Let’s see how it really works.

How RD Works in Everyday Life

Think of RD as a monthly commitment you make to your future. Just like paying your child’s school fee or utility bills you put aside the same amount each month. The difference is that, unlike bills, this payment comes back to you with extra earnings. At present the Post Office RD offers an interest rate of 6.7% per annum (compounded quarterly). This means the money doesn’t just sit idle every quarter your savings grow a little more and the interest earned itself begins to earn interest. That’s the beauty of compounding.

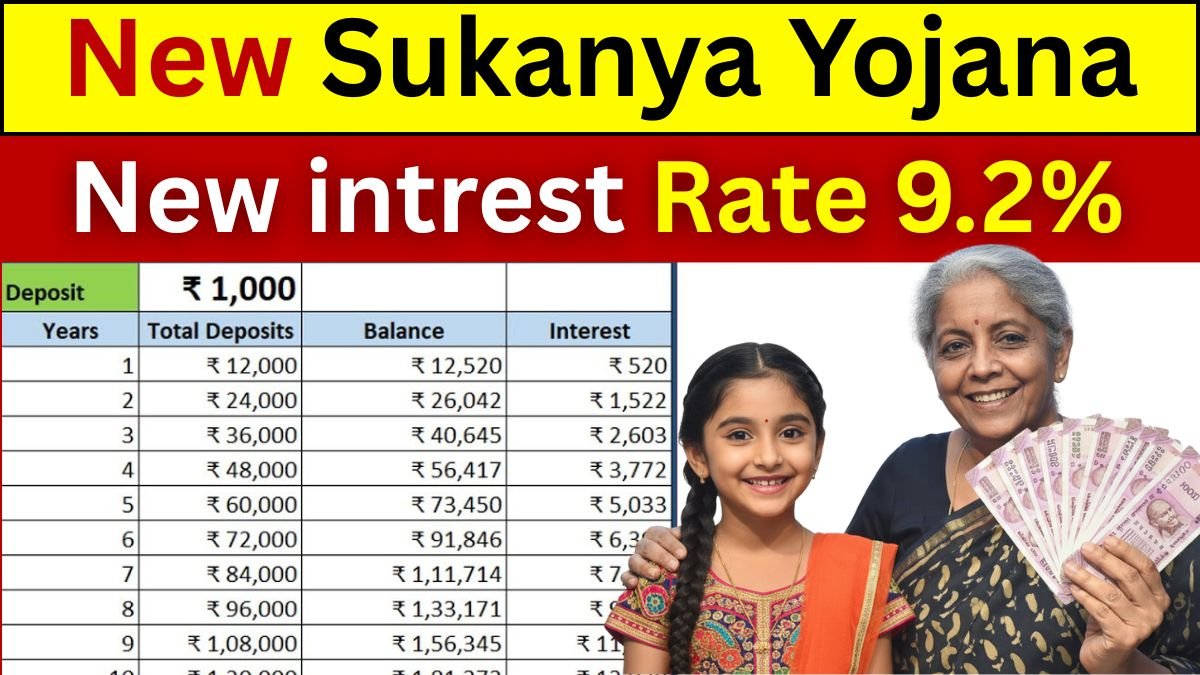

Read more: ₹38k Saving Can Grow Into ₹17,54,986 for Your Daughter – Sukanya Samriddhi Yojana

Exact Calculation of ₹15,000 in RD

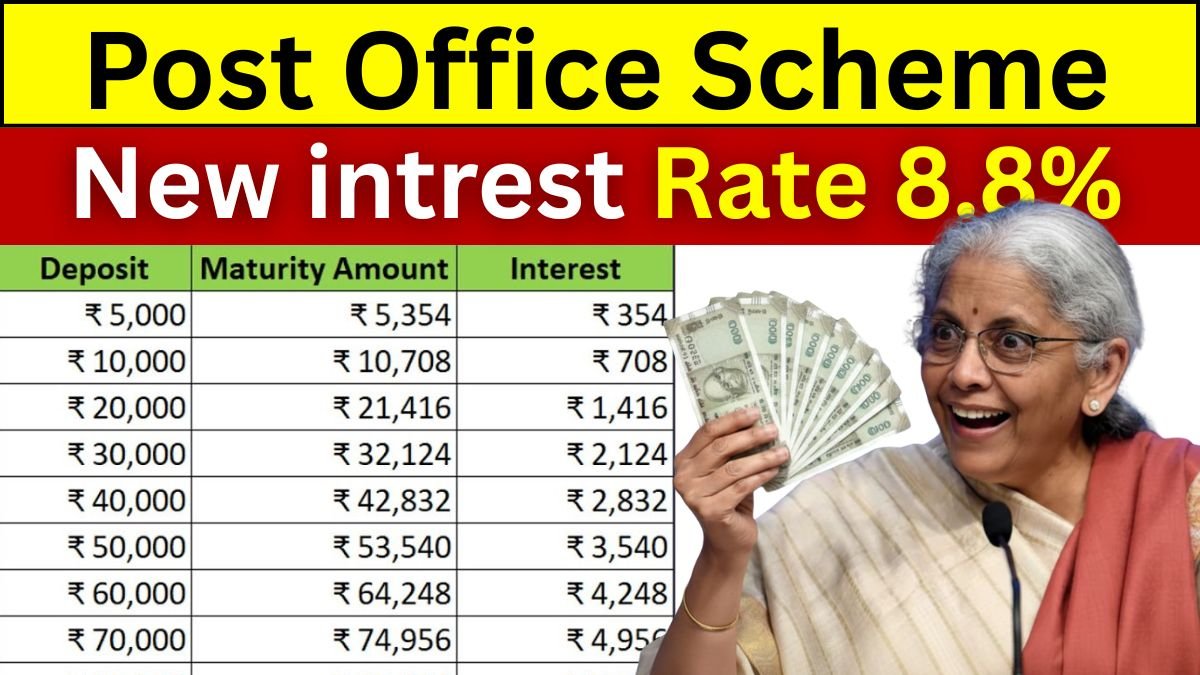

Here’s a clear breakdown of how ₹15,000 every month grows in the Post Office RD over five years

| Monthly Deposit | Tenure | Interest Rate | Total Deposit | Maturity Amount | Total Interest Earned |

|---|---|---|---|---|---|

| ₹15,000 | 5 Years | 6.7% (Quarterly Compounded) | ₹9,00,000 | ₹10,70,492 | ₹1,70,492 |

So, while you actually deposit only ₹9 lakh, your final maturity amount becomes ₹10.70 lakh, with an extra ₹1.70 lakh purely from interest.

Why RD is Popular Among Families

RD feels like a comfort plan for many households. Salaried individuals love it because the fixed monthly savings fit perfectly into their budget. Parents often choose it to prepare for future milestones a child’s education, a wedding, or just building a safety cushion. It’s like planting a small sapling every month. At first, it looks ordinary, but after five years, you realize it has grown into a strong tree that gives you both shade and security.

Conclusion

The Post Office RD scheme is proof that steady steps can lead to big achievements. By simply saving ₹15,000 every month, you can build a guaranteed maturity fund of ₹10,70,492 in five years. It’s safe, risk-free, and an excellent way for families to create financial security without stress.

Disclaimer

This article is only for educational and general knowledge purposes. Interest rates in Post Office RD may change as per government updates. Please check the latest details from official India Post sources or consult a financial advisor before investing.