Post Office FD Scheme: When it comes to saving money safely, most people in India still trust the Post Office Fixed Deposit Scheme more than anything else. It’s steady, government-backed, and gives peace of mind you know exactly how much you’ll get at the end. Now, if you invest ₹4 lakh in a Post Office FD, you’ll receive about ₹5,79,979 after a few years. Sounds interesting, right? Let’s break it down in simple words and see how this amount is calculated.

What Makes Post Office FD a Safe Investment

Unlike market-linked investments, a Post Office Fixed Deposit (also called the Time Deposit) doesn’t depend on ups and downs. Your money earns a fixed interest rate for the entire period you choose and you can open an FD for 1, 2, 3, or 5 years.

The good part is that you can start with as little as ₹1,000, and there’s no upper limit. Right now, the interest rate for 5 years is 7.5% per annum, which is among the best in safe investment options. The interest is compounded quarterly, meaning every few months, your interest itself starts earning more interest and that’s where the magic happens.

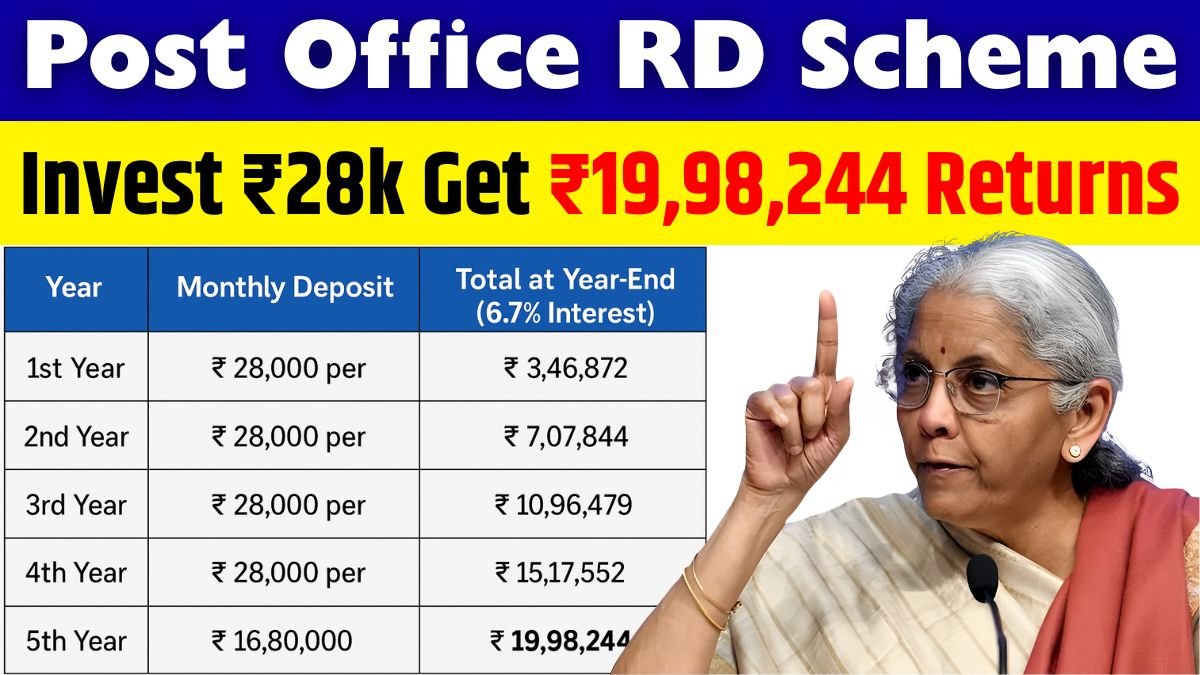

Read more: invest ₹28,000 You’ll Get ₹19,98,244 Returns After 5 Years – Post Office RD Scheme

₹4 Lakh FD Full 5-Year Calculation

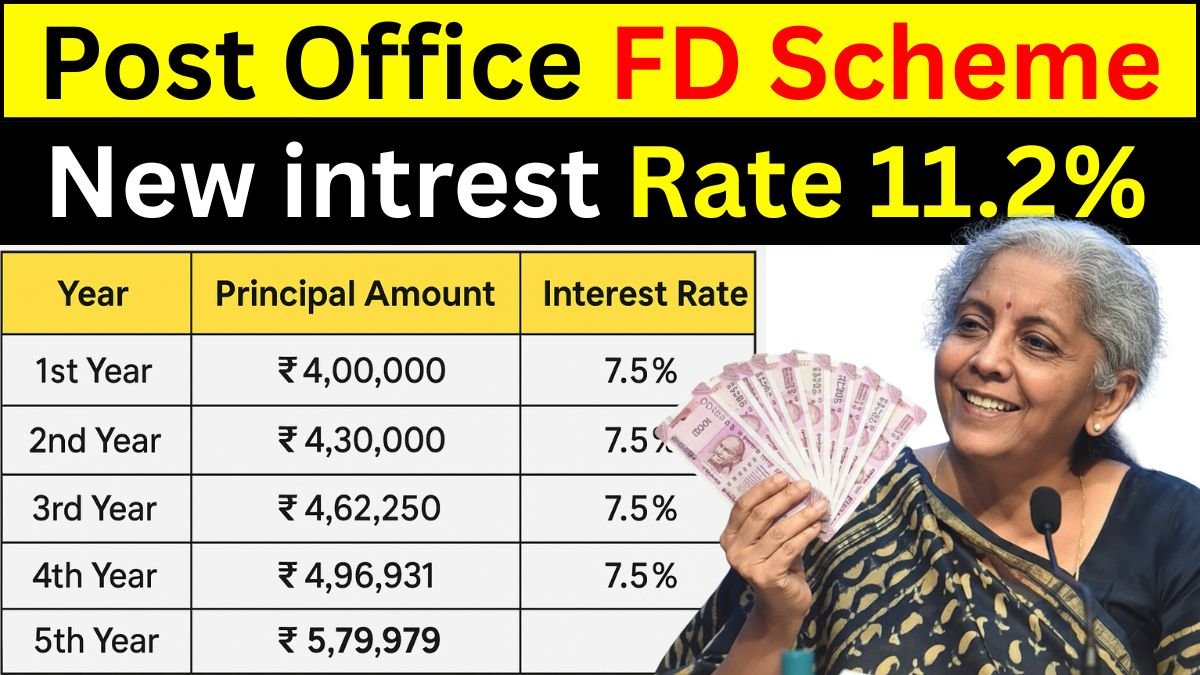

Here’s a simple table showing how your ₹4 lakh investment grows with the 7.5% annual rate over 5 years:

| Principal Amount | Tenure | Interest Rate | Total Interest Earned | Maturity Amount |

|---|---|---|---|---|

| ₹4,00,000 | 5 Years | 7.5% (Compounded Quarterly) | ₹1,79,979 | ₹5,79,979 |

So, by keeping your ₹4 lakh invested for 5 years, you earn ₹1,79,979 as interest without taking any risk. That’s how safe compounding quietly multiplies your savings over time.

Why People Still Prefer Post Office FD

Even though banks and private apps advertise fancy investment products, many still go with Post Office FD especially retirees, homemakers, and people who value safety over high returns. It’s perfect for short-term goals too like your child’s college fees after a few years, or simply building a small emergency fund. You can also choose to receive interest monthly or annually if you want regular income. The best part? Since it’s backed by the Government of India, your money is 100% secure.

Conclusion

The Post Office FD Scheme proves that patience always pays. By investing ₹4 lakh, you can receive around ₹5,79,979 after 5 years with 7.5% interest. It’s reliable, easy to understand, and a great choice if you want peace of mind along with steady growth.

Disclaimer

This article is only for educational and general information purposes. Post Office FD interest rates may change as per government updates. Please confirm the latest rate and terms from official India Post sources before investing.