Home Loan: You know owning a house isn’t just about having four walls. It’s that feeling your own space, your own peace. Everyone wants that one home where they can finally stop paying rent and just say Yeah this is mine. But before that dream turns real there’s one step that almost every middle-class person takes a home loan. Now the question that comes right after is simple If I take ₹18 lakh, how much EMI will I actually pay? Let’s talk about that, no banking terms, no big words just straight and clear.

So, What’s a Home Loan Really?

It’s basically the bank helping you buy your house. You borrow the money, and then repay it in monthly bits EMIs. Those EMIs have both your principal and interest. Because it’s a secured loan, banks don’t charge crazy interest like they do on personal loans. In India right now, home loans usually come around 8.5% to 9.5% per year, and you can stretch it from 10 to 30 years. Longer time means smaller EMI, but yeah, you end up paying more interest. Shorter time means bigger EMI but less total cost. It’s a choice comfort or savings.

Read more: If You Save ₹38k for Your Child, You’ll Get ₹10,30,613 After Maturity – Post Office PPF Scheme

₹18 Lakh Home Loan EMI Calculation

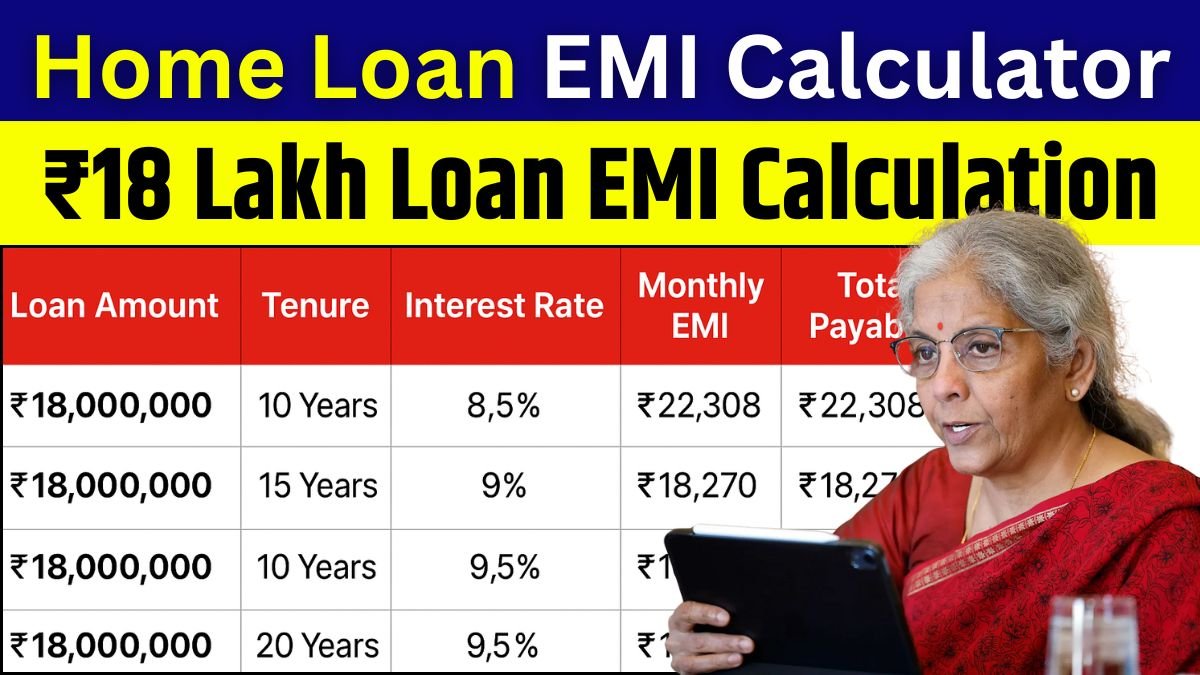

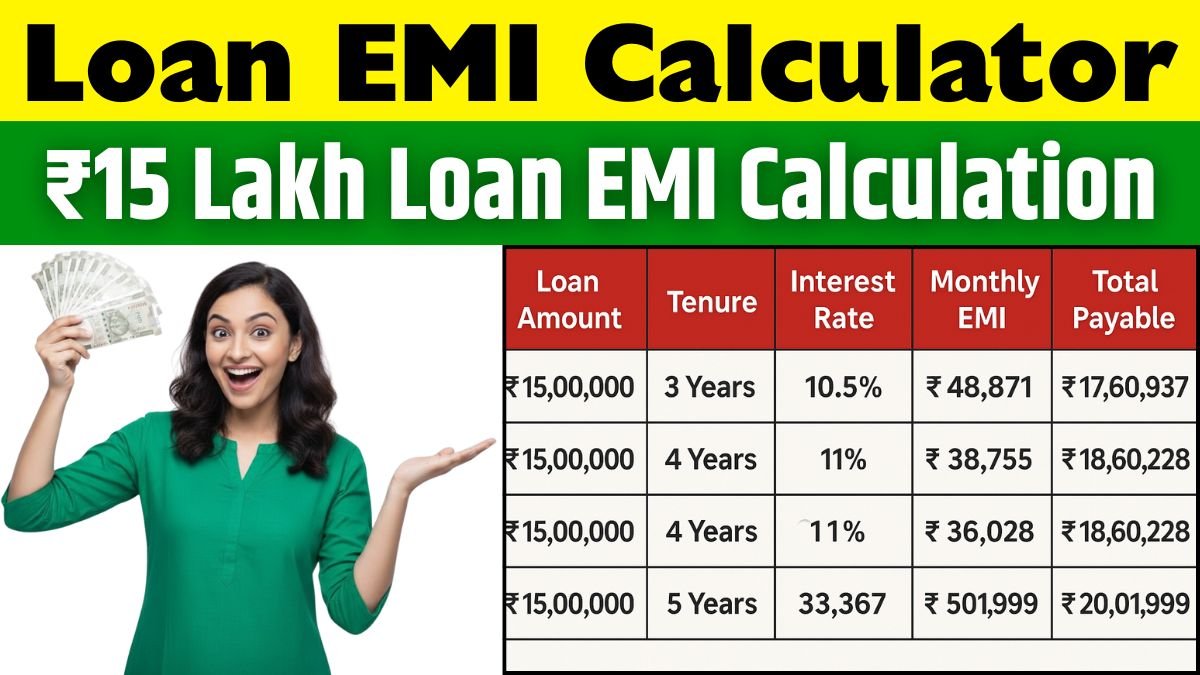

| Loan Amount | Tenure | Interest Rate | Monthly EMI | Total Interest | Total Payable |

|---|---|---|---|---|---|

| ₹18,00,000 | 10 Years | 8.5% | ₹22,308 | ₹9,67,000 | ₹27,67,000 |

| ₹18,00,000 | 15 Years | 9% | ₹18,270 | ₹14,88,600 | ₹32,88,600 |

| ₹18,00,000 | 20 Years | 9.5% | ₹16,737 | ₹22,56,880 | ₹40,56,880 |

See how it changes? If you take 10 years, you’ll pay around ₹22,300 each month. Manageable, but only if your income allows it. Go for 20 years, and it drops to ₹16,700, which is easier monthly but you pay a lot more in total. That’s why planning matters.

Why CIBIL Score and Income Make the Difference

Banks love stable people someone with a steady job and a clean payment history. If your CIBIL score is above 750, you’ll likely get a better deal, maybe 8.5% or even less. But if it’s low, banks play it safe and charge you higher interest. It’s like trust once you build it, you get better offers everywhere.

Why Home Loan Isn’t a Burden

People often think loans mean stress. But honestly, a home loan is an investment in peace. You’re paying rent anyway why not pay it for something that becomes yours? Plus, there are tax benefits too. Under Section 80C and 24(b), you can claim deductions on both principal and interest. That’s real saving right there.

Conclusion

For an ₹18 lakh home loan, your EMI will roughly stay between ₹16,000 and ₹22,000, depending on tenure and rate. Don’t see it as a burden see it as a step towards your dream house. The key is to borrow smart, pay on time, and slowly, month by month, make that dream your reality.

Disclaimer

This article is only for educational and general information purposes. Loan interest rates and EMIs may vary by bank and over time. Always confirm the latest details from official sources before taking any financial decision.