Sukanya Samriddhi Yojana: Every parent dreams of giving their daughter a bright, secure, and worry-free future. Whether it’s higher education or her wedding, parents want to ensure that money never becomes a reason to stop her dreams. And for that, one of the most trusted government-backed schemes is the Sukanya Samriddhi Yojana (SSY) designed specially for the girl child’s financial security. Now here’s the amazing part if you invest ₹50,000 every year, this small amount can turn into around ₹23,09,193 by the time the scheme matures. Let’s see how this magic of compounding actually works.

What Is Sukanya Samriddhi Yojana

The Sukanya Samriddhi Yojana is a savings plan launched by the Government of India under the Beti Bachao Beti Padhao initiative. It helps parents build a strong financial fund for their daughter’s education or marriage.

You can open this account in any Post Office or authorized bank, right after the birth of your daughter till she turns 10 years old. The minimum deposit is ₹250, and you can invest up to ₹1.5 lakh every year. The current interest rate is 8.2% per annum, which is higher than most fixed deposits, and the interest is compounded yearly. The best part the entire amount, including interest, is tax-free under Section 80C.

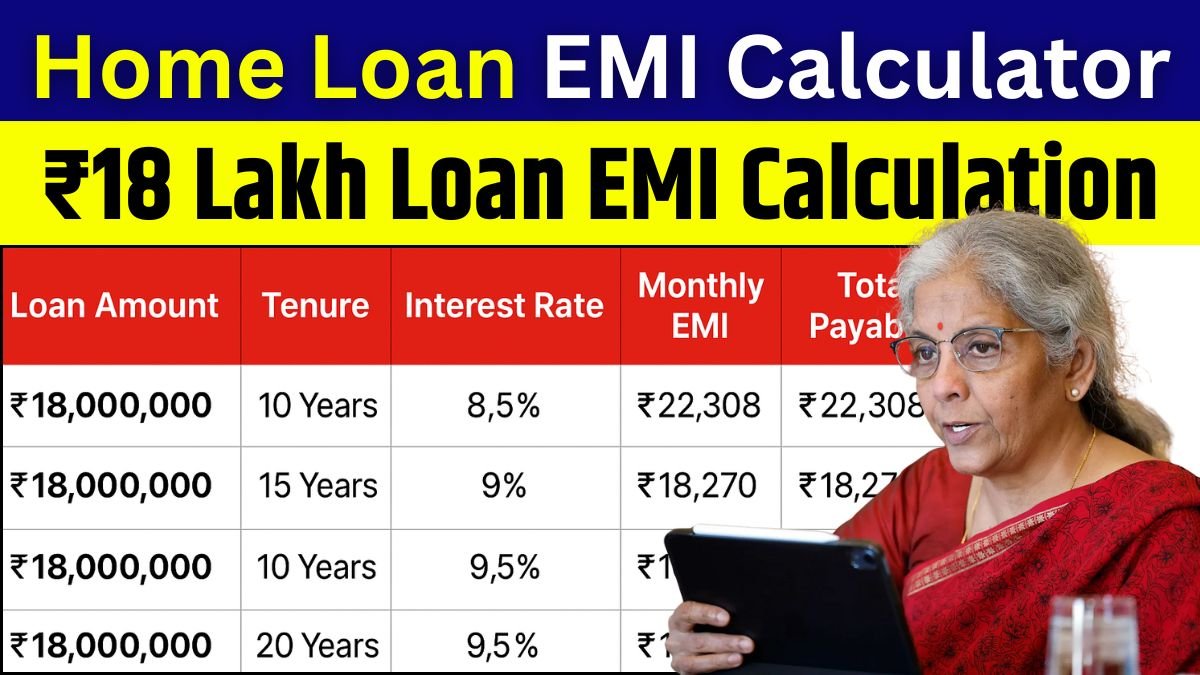

Read more: EMI Calculation on ₹18 Lakh Home Loan with Interest and Full Details

₹50,000 Investment Full Calculation

Let’s check what happens if you deposit ₹50,000 every year for 15 years and then let it mature after 21 years.

| Yearly Deposit | Total Years | Interest Rate | Total Amount Deposited | Maturity Value |

|---|---|---|---|---|

| ₹50,000 | 15 Years (Deposit Period) + 6 Years (Interest Period) | 8.2% (Yearly Compounded) | ₹7,50,000 | ₹23,09,193 |

That means you’ll deposit only ₹7.5 lakh, and by maturity, it grows to over ₹23 lakh a gain of more than ₹15.5 lakh. That’s the real power of long-term compounding and government-backed security working together.

Why This Scheme Is Perfect for Daughters

Think about it no market risk, guaranteed growth, and complete tax benefits. This scheme doesn’t just help save money it helps parents plan emotionally and financially for their daughter’s milestones.

It’s ideal if you want to ensure her higher education, or just have peace of mind knowing that no matter what, her dreams will never stop for financial reasons. And since the scheme allows partial withdrawal after your daughter turns 18, you can even use part of the fund when she needs it the most like for college admission.

Conclusion

For any parent, Sukanya Samriddhi Yojana is more than just a savings plan it’s a gift of security. By investing ₹50,000 every year, you can create a solid fund of ₹23,09,193 for your daughter’s future. It’s safe, tax-free, and filled with emotional value because behind every rupee saved lies the love and dreams of a parent.

Disclaimer

This article is meant only for educational and general knowledge purposes. Sukanya Samriddhi Yojana interest rates may change as per government updates. Please verify the latest details from official India Post or bank sources before making any investment.