PNB FD Scheme: You know how people always say save your money where it feels safe. Well, that’s exactly what a Fixed Deposit (FD) does. And when it comes to trust, Punjab National Bank (PNB) still stands tall among all. It’s not just a bank name for many families, it’s an emotion tied with security and stability. Now, if you put ₹5 lakh in a PNB FD, that money quietly keeps working for you. After a few years, it can grow into ₹7,16,130 without you having to do anything extra. Let’s talk about how it actually happens, in simple words.

Why People Still Trust PNB FD

The good thing about PNB is that it gives you options you can choose to keep your FD for just a few months or even up to 10 years. Most people who want to grow their savings safely go for 5-year FDs, because the interest rate is higher. Right now, the rate of interest is about 7.25% per year, which is quite solid. And if you’re a senior citizen, you get a little bonus around 7.75%. The bank compounds the interest every three months, which means your money earns interest on interest. That’s how it grows faster without you even noticing.

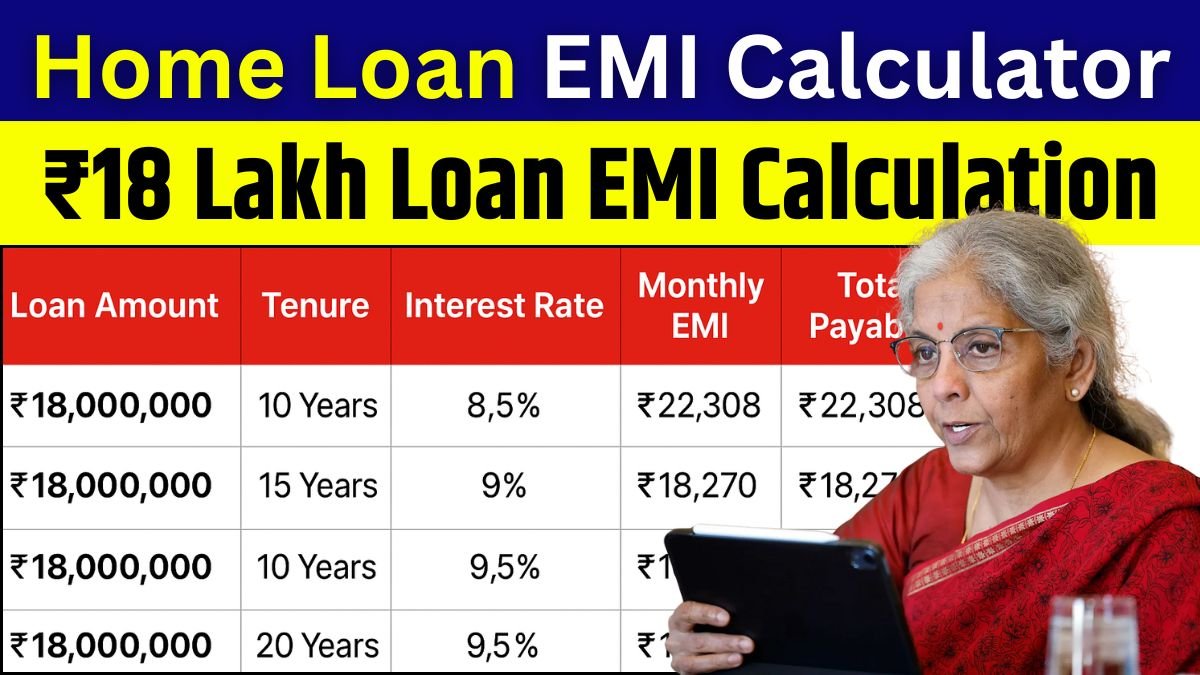

Read more: EMI Calculation on ₹18 Lakh Home Loan with Interest and Full Details

Example ₹5 Lakh FD for 5 Years

| Deposit Amount | Tenure | Interest Rate | Total Interest Earned | Final Maturity Amount |

|---|---|---|---|---|

| ₹5,00,000 | 5 Years | 7.25% (Quarterly Compounding) | ₹2,16,130 | ₹7,16,130 |

So, after five years, your ₹5 lakh turns into ₹7.16 lakh a clear, guaranteed return of over ₹2.16 lakh. And if your parents or grandparents invest the same amount (because they get higher rates), they’ll receive close to ₹7.16 lakh at maturity.

Why FD Still Makes Sense

Let’s be honest FDs don’t make you rich overnight. But they do give you something more valuable peace of mind. You know your money is safe, the returns are fixed, and you’ll get the exact amount you expect. Many people still keep one FD aside for future plans like their child’s education, wedding, or even as a backup for emergencies. It’s not about chasing high profits; it’s about being ready when life throws surprises. And the best part? You can choose how you want to receive the interest every month, every quarter, or all at once at maturity. That flexibility makes it even better.

Conclusion

If you want an investment that’s simple, safe, and steady, the PNB Fixed Deposit Scheme is a solid choice. By putting ₹5 lakh for 5 years, you earn ₹2,16,130 as interest and take home a total of ₹7,16,130. No market risks, no hidden surprises just pure, peaceful growth.

Disclaimer

This article is meant only for general and educational purposes. PNB FD interest rates may change from time to time, so please verify the latest details from official PNB sources or your nearest branch before investing.