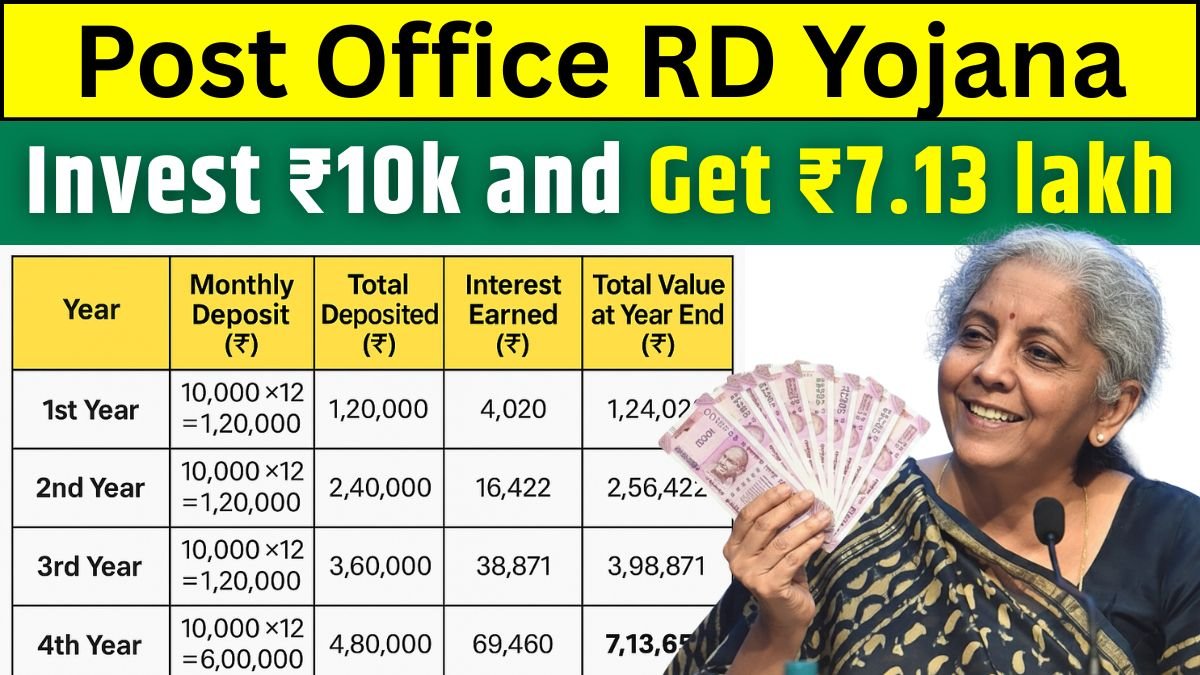

Post Office RD Yojana: There’s something comforting about saving a fixed amount every month. It’s simple disciplined and it gives you peace of mind knowing that your money is quietly growing in the background. For most middle-class families this habit starts with a Post Office Recurring Deposit (RD) a plan that turns small savings into a solid lump sum over time. Now if you invest ₹10,000 every month you can build a fund of around ₹7,13,643 in just a few years. Let’s break it down in simple human terms so you can see how this magic happens.

What Makes Post Office RD So Reliable

The Post Office RD Scheme is one of the safest and most popular small savings plans in India. It’s fully backed by the Government of India, which means your money is completely secure no risks, no market ups and downs. The best part is that you can start with a very small amount, and deposits are made every month. It helps people who want to save regularly but don’t want to lock up a large amount at once. As of now, the interest rate on Post Office RD is 6.7% per annum, compounded quarterly. The minimum tenure is 5 years, and you can extend it if you wish. Now let’s see what happens when you invest ₹10,000 each month.

Read more: If You Invest ₹5 Lakh in an FD, You’ll Get ₹7,16,130 After How Many Years? – PNB FD Scheme

₹10,000 Monthly Deposit Full 5-Year Calculation

Here’s a clear look at how your money grows in the Post Office RD over a 5-year period.

| Monthly Deposit | Tenure | Interest Rate | Total Amount Deposited | Maturity Value |

|---|---|---|---|---|

| ₹10,000 | 5 Years | 6.7% (Compounded Quarterly) | ₹6,00,000 | ₹7,13,643 |

So, after 5 years, you would have invested a total of ₹6 lakh. And with the power of compounding, it becomes ₹7,13,643, giving you a gain of ₹1,13,643. That’s steady, risk-free growth and it’s completely predictable, unlike the ups and downs of mutual funds or shares.

Why Post Office RD Still Makes Sense Today

In a world where people are running after fast profits, the RD scheme reminds us that slow and steady still works. It’s perfect for people who want to save regularly salaried employees, small business owners, or even homemakers. Every month, when you deposit ₹10,000, it builds your financial discipline. By the time the 5 years are over, you’ll have a tidy amount waiting for you maybe for a child’s education, a vacation, or simply as your safety fund. And yes, the biggest comfort your money is with India Post, not in some risky fund.

Conclusion

If you want a savings plan that’s safe, simple, and guaranteed, the Post Office RD Yojana is a great option. By investing just ₹10,000 a month, you can get ₹7,13,643 in 5 years without worrying about market risks. It’s perfect for anyone who believes in saving consistently and watching their money grow peacefully.

Disclaimer

This article is meant for educational and general knowledge purposes only. Post Office RD interest rates may change from time to time as per government updates. Please check the latest details from your nearest post office or official India Post sources before investing.