CIBIL Score: You know how it feels when you finally decide Yes, I want my own car or bike? It’s not just about owning something on wheels it’s more like a feeling of freedom. That first ride, that pride when you park it outside your home it means something. But before that dream even begins, there’s this one tiny thing every bank will check first your CIBIL score. Let’s be real. Most people don’t think about it until they apply for a loan. But this little number can decide whether you get that car or bike or not. So yeah, let’s make it simple and talk about what really matters.

What CIBIL Score Actually Means

Think of it like your personal report card but for money. It’s a number from 300 to 900 that tells banks how responsible you’ve been with loans, EMIs, or credit cards. If you’ve paid everything on time, your score stays high. If you’ve missed payments or delayed EMIs well, it drops. And banks don’t like that. Basically, this score tells them whether you’re a safe bet or a risky one. The higher it is, the easier it becomes to get a loan and at a better rate too.

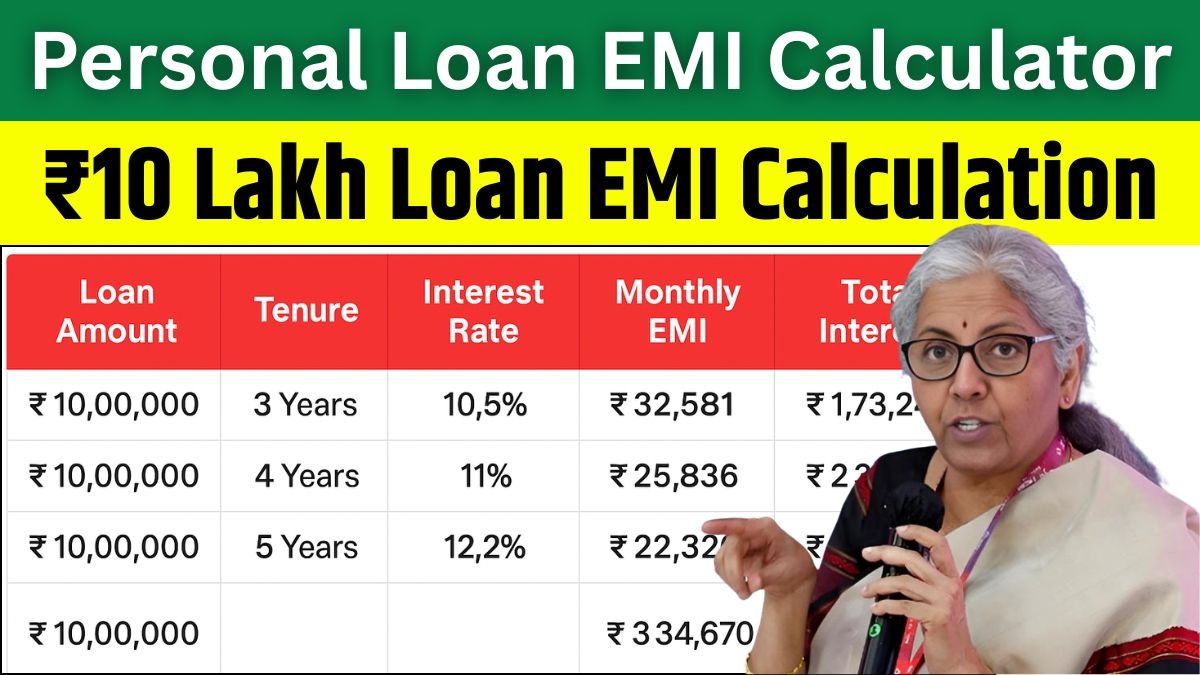

Read more: Personal Loan: EMI Calculation for ₹20 Lakh Loan with Interest Details

Minimum and Ideal Score for Car and Bike Loans

| Loan Type | Minimum CIBIL Score | Ideal CIBIL Score | Interest Range |

|---|---|---|---|

| Bike Loan | Around 650 | 750+ | 9% – 14% |

| Car Loan | Around 700 | 750+ | 8.5% – 12% |

If your score is above 750, you’re safe. Banks trust you quickly, approvals are smooth, and sometimes they even lower your interest rate. If your score is between 650–700, you might still get approved but maybe with a higher interest. Not bad, but could be better. Let’s say Arjun and Neha both apply for a ₹7 lakh car loan. Arjun’s score is 780, Neha’s is 660. Arjun gets the loan at 9%, Neha gets it at 11.5%. Small difference? Maybe. But over a few years, it adds up to thousands.

If Your Score is Low, Don’t Panic

Honestly, a low CIBIL score isn’t the end of the road. You can fix it. Start by paying bills on time, don’t use too much credit, and don’t apply for too many loans at once. In a few months, it starts improving slowly, but surely. Your credit score is like your reputation it takes time to build, but once it’s solid, life becomes a lot easier.

Conclusion

If you’re planning to buy a bike, try keeping your score above 650. For a car, anything above 700 works fine. But if you cross 750, you’ll get the best deals lower interest, faster approval, fewer worries. Build your score like you build trust steady and consistent. Once you have that, banks will open doors faster than you expect.

Disclaimer

This article is only for educational and general knowledge purposes. CIBIL score requirements and interest rates can change from time to time. Always check with your bank or lender for the latest details before applying for a loan.