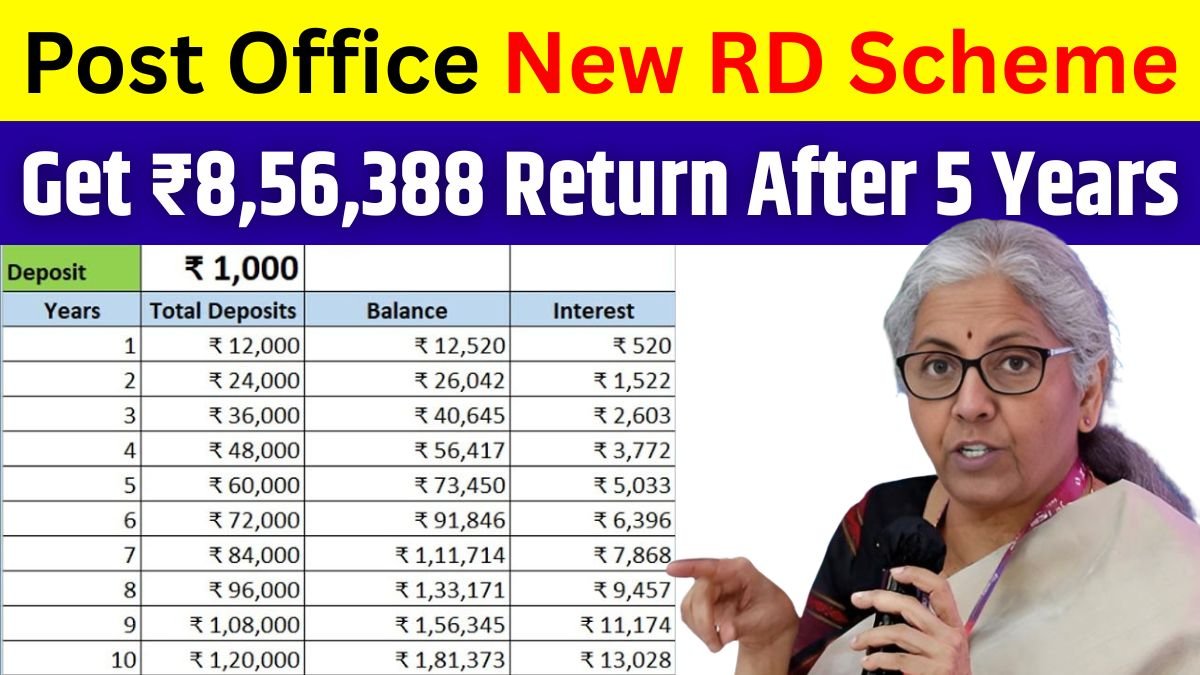

Post Office RD Scheme: Saving is not about how much you earn it’s about how regularly you set something aside. The Post Office Recurring Deposit (RD) scheme proves this point beautifully. It allows you to save a fixed amount every month, and with the power of compounding, your savings grow bigger than you expect. Now imagine this if you deposit ₹12,000 every month, in just 5 years your money will become ₹8,56,388. This is not a dream it’s a real calculation backed by government security. Let’s understand it clearly.

How RD Works in the Post Office

The Post Office RD is like a disciplined friend who makes sure you save every month. You decide the deposit amount here, ₹12,000 and put it in your RD account. Every three months, interest is added, and that interest also starts earning interest. Currently, the Post Office RD offers 6.7% annual interest rate, compounded quarterly. Since this scheme is government-backed, your money remains safe no matter what happens in the market.

Read more: How Much Will ₹3 Lakh FD Return in 5 Years? Check Calculation – Post Office FD Scheme

₹12,000 RD Calculation for 5 Years

Here’s the clear maturity calculation of a ₹12,000 monthly deposit in the Post Office RD for 5 years.

| Monthly Deposit | Tenure | Interest Rate | Total Deposit | Maturity Amount | Total Interest Earned |

|---|---|---|---|---|---|

| ₹12,000 | 5 Years | 6.7% (Quarterly Compounded) | ₹7,20,000 | ₹8,56,388 | ₹1,36,388 |

So, your disciplined savings of ₹7.20 lakh turn into ₹8.56 lakh in 5 years, giving you an extra ₹1.36 lakh as interest.

Why RD is Perfect for Families

Families love RD because it fits easily into a monthly budget, just like paying electricity or school fees. It feels small in the moment, but at the end of five years, you suddenly realise you’ve built a strong fund. It’s like watering a small plant every month. You don’t see much change at first, but over the years, it grows into a strong tree. That’s exactly how RD nurtures your savings.

Conclusion

The Post Office RD scheme is an ideal choice for anyone who wants safe, regular, and guaranteed savings. By depositing ₹12,000 every month, you can build a maturity amount of ₹8,56,388 in 5 years. It’s a simple and risk-free way to secure your family’s future without stress.

Disclaimer

This article is for educational and general knowledge purposes only. Interest rates in the Post Office RD scheme may change with government updates. Please check the latest details from official India Post sources or consult a financial advisor before investing.