Personal Loan: You know how life works, right? One day everything’s fine, and the next day some big expense just pops up. Maybe it’s your sister’s wedding, maybe you want to redo your house, or maybe you’ve got some medical bills waiting. That’s when a personal loan comes in handy quick simple and no need to give the bank any property or gold. But before jumping into it, the real question everyone asks how much EMI will I actually pay every month? Let’s talk about that like normal people not in finance language.

What a Personal Loan Really Is

A personal loan is just borrowed money that you repay in small parts every month. No collateral no stress. Banks look at your salary your CIBIL score, and your past payment record to decide how much to give and at what interest rate. Right now in India most banks charge somewhere between 10.5% to 15% interest per year and you can repay it over 1 to 5 years, depending on what fits your pocket.

Read more: If You Deposit ₹25,000, You’ll Get ₹6,78,035 After Maturity? – Post Office PPF Scheme

EMI on ₹15 Lakh Loan Let’s See the Real Math

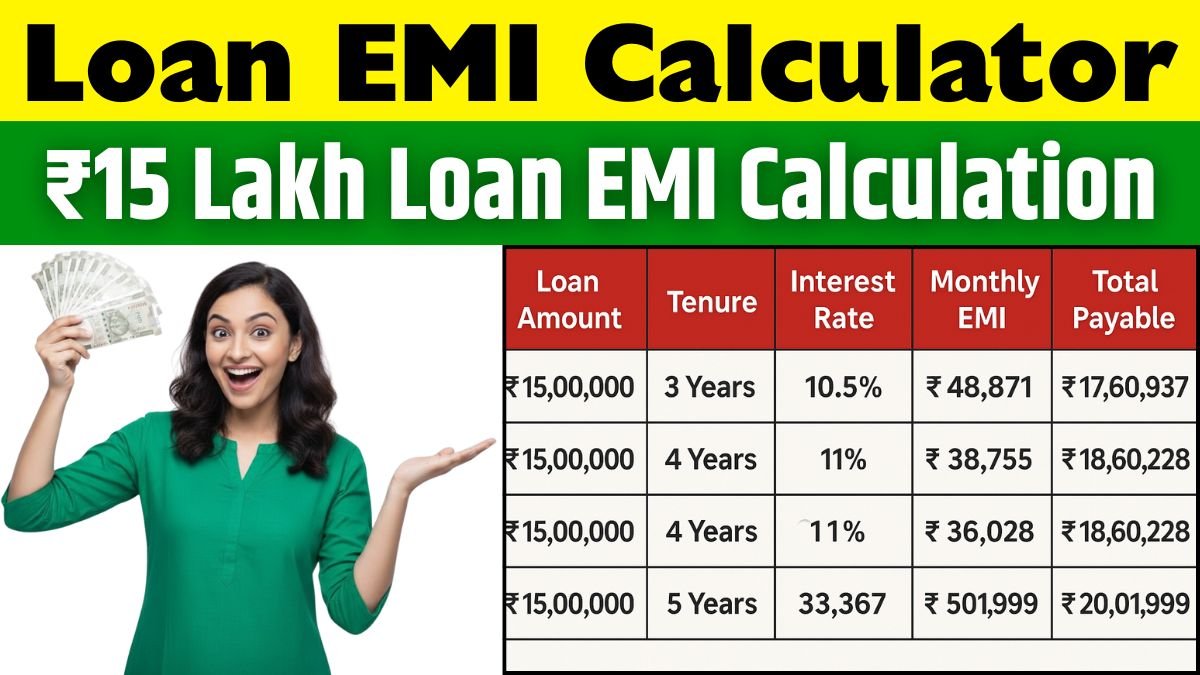

| Loan Amount | Tenure | Interest Rate | Monthly EMI | Total Interest | Total Payable |

|---|---|---|---|---|---|

| ₹15,00,000 | 3 Years | 10.5% | ₹48,871 | ₹2,60,937 | ₹17,60,937 |

| ₹15,00,000 | 4 Years | 11% | ₹38,755 | ₹3,60,228 | ₹18,60,228 |

| ₹15,00,000 | 5 Years | 12% | ₹33,367 | ₹5,01,999 | ₹20,01,999 |

So, if you go for 5 years, your EMI will be around ₹33,000, easy to manage every month but more total interest. If you choose 3 years, EMI jumps to ₹48,000+, but you save big on interest. That’s the trade-off lower EMI vs higher cost. You’ve got to pick what suits your situation.

How CIBIL Score Affects Everything

Let’s be real your CIBIL score decides how friendly banks will be with you. If your score is above 750, you’re in the good books. You’ll get better rates, faster approval and maybe even a few perks. If it’s low banks will still give you the loan sometimes but you’ll end up paying more interest. It’s like trust if you’ve been good with money banks trust you more. Simple.

A Small Example

Let’s say Arjun and Meera both apply for a ₹15 lakh loan. Arjun’s CIBIL score is 770, Meera’s is 670. Arjun gets his loan at 10.5%, Meera at 13%. Same amount, same years but Meera will pay almost ₹1 lakh more just because her score is lower. That’s why keeping a good score matters it saves you real money, not just points on paper.

Conclusion

If you’re planning a ₹15 lakh personal loan, your EMI will roughly fall between ₹33,000 and ₹49,000 depending on your interest and tenure. Always check your CIBIL score first, and don’t rush. Pick a plan that doesn’t make your month tight. A loan can help, but only if you handle it smartly.

Disclaimer

This article is only for education and general awareness. Loan rates and EMIs differ from bank to bank and may change over time. Always confirm the details from official bank sources before applying.