Personal Loan: There are moments in life when you just need a little extra money maybe for a wedding, a new business setup, or a medical expense that can’t wait. That’s where a personal loan comes into play. It gives you quick access to funds without asking you to mortgage your property or pledge anything valuable. But before you apply, it’s important to know one thing clearly how much EMI will you actually have to pay every month? Let’s talk about that in a simple real way.

What a Personal Loan Actually Means

A personal loan is money borrowed from a bank or financial institution that you pay back in small monthly instalments, called EMIs. You don’t have to provide any security, which makes it easier to get, but the interest rate depends on how strong your CIBIL score and income record are. Currently, most banks in India offer personal loans with interest rates between 10.5% and 15% per annum, and the repayment tenure can range from 1 to 5 years.

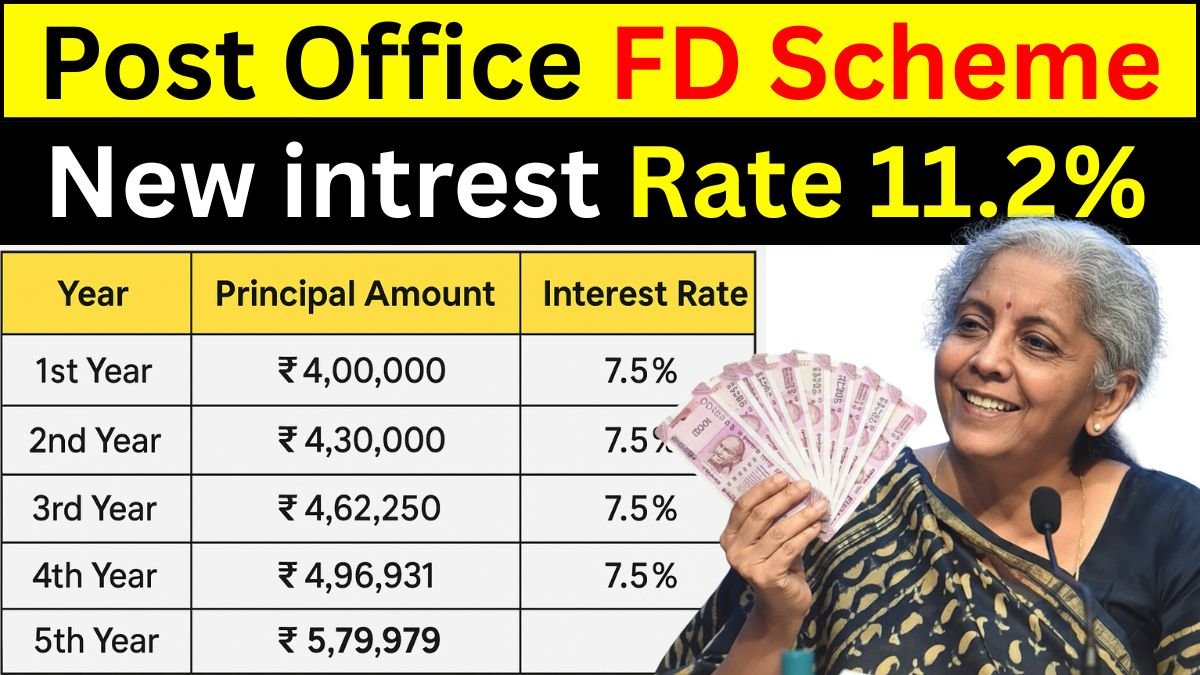

Read more: How ₹4 Lakh Can Grow Into ₹5,79,979 Full Calculation Explained – Post Office FD Scheme

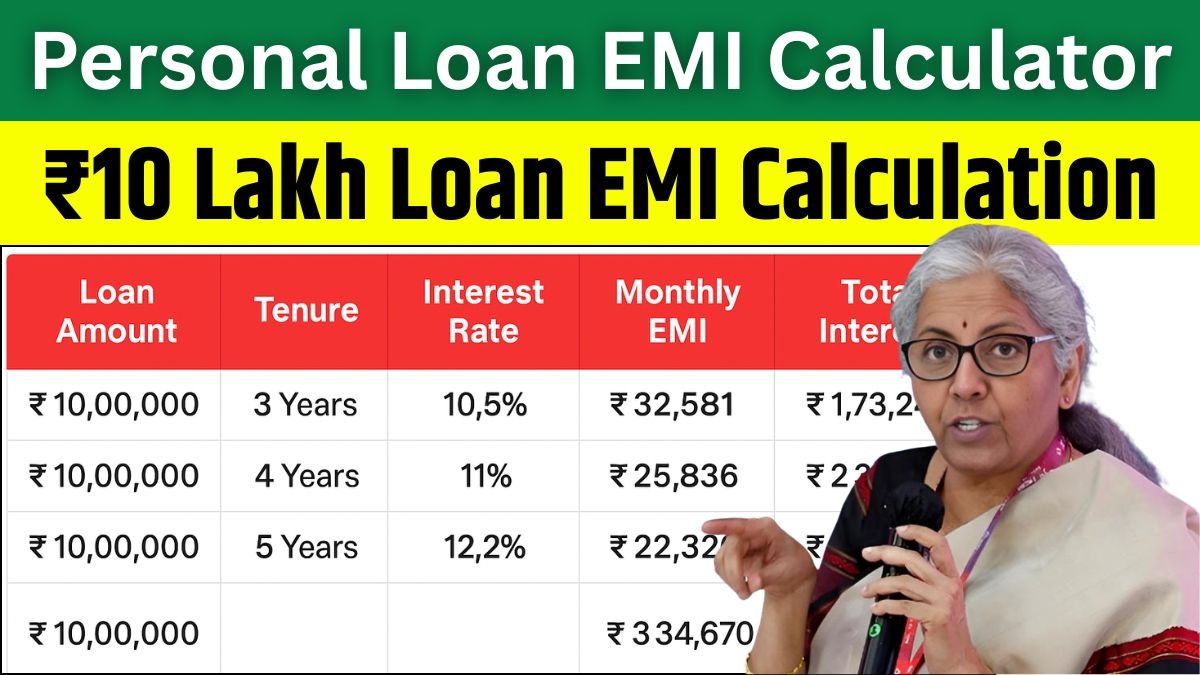

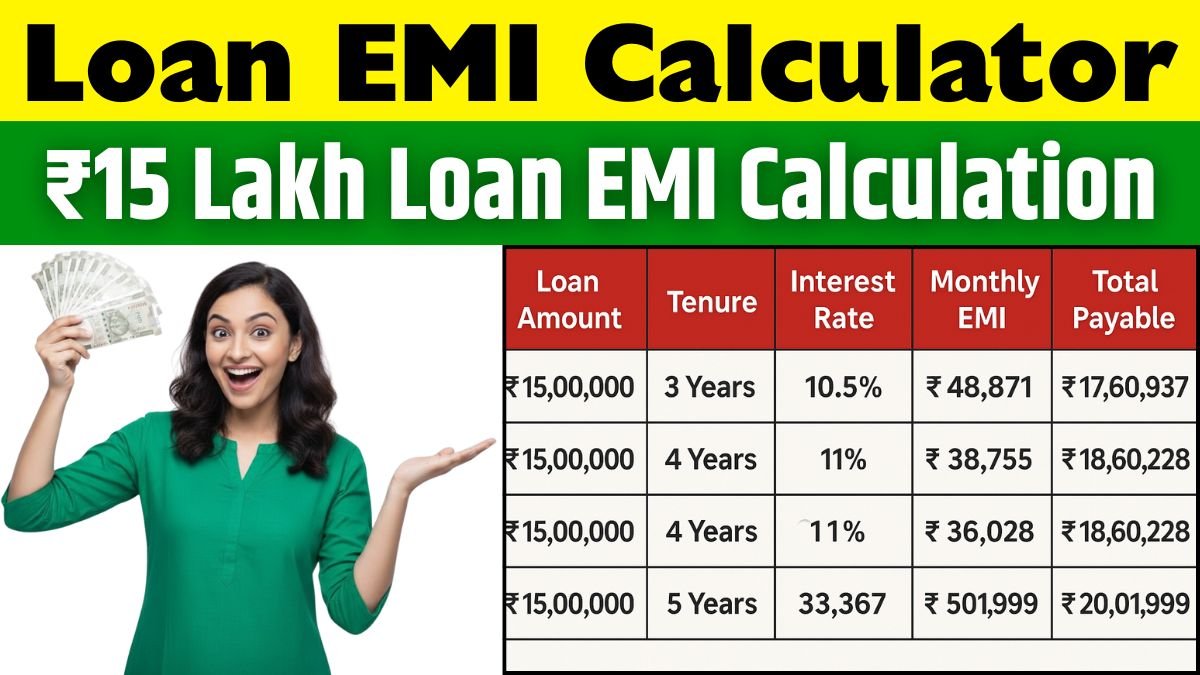

₹10 Lakh Loan EMI Breakdown with Interest

Let’s look at a simple calculation of how much EMI you’ll pay on a ₹10 lakh loan at different interest rates and tenures.

| Loan Amount | Tenure | Interest Rate | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| ₹10,00,000 | 3 Years | 10.5% | ₹32,581 | ₹1,73,242 | ₹11,73,242 |

| ₹10,00,000 | 4 Years | 11% | ₹25,836 | ₹2,39,974 | ₹12,39,974 |

| ₹10,00,000 | 5 Years | 12% | ₹22,326 | ₹3,34,670 | ₹13,34,670 |

So, if you take a 5-year loan, your EMI will be around ₹22,326 easier to manage but with more total interest. If you go for 3 years, the EMI will be around ₹32,581 higher every month, but you’ll save nearly ₹1.6 lakh in total interest. That’s the balance you have to find comfort versus cost.

Why Your CIBIL Score Matters

Your CIBIL score is like your financial report card. It shows how disciplined you’ve been with credit cards and previous loans. If your score is 750 or above, banks will see you as a low-risk borrower, and you’ll likely get lower interest rates. But if it’s lower, the loan can still be approved just at a slightly higher rate. Think of it as your trust score the better your history, the more confidence the bank has in you.

A Simple Example

Let’s say Ravi and Neha both apply for a ₹10 lakh loan. Ravi’s score is 780, while Neha’s is 660.

Ravi gets the loan at 10.5%, Neha at 13%. Same amount, same years but Neha ends up paying about ₹70,000 more, just because her score was lower. So yes, keeping your credit clean actually saves you money.

Conclusion

A personal loan can truly be a support system during financial needs. For a ₹10 lakh loan, your EMI will roughly fall between ₹22,000 and ₹33,000, depending on interest and tenure. Always compare offers from different banks, check your CIBIL score, and choose a tenure that fits your monthly comfort zone. Borrow smart and a loan won’t feel like a burden.

Disclaimer

This article is only for educational and general knowledge purposes. Interest rates, EMIs, and terms may vary between banks and change over time. Please verify details from official bank sources or financial experts before taking any loan decision.