Sukanya Samriddhi Yojana: Every father dreams of giving his daughter a secure and comfortable life. Whether it’s her higher education, her wedding, or her dreams of starting something on her own the biggest wish is that money never becomes a problem for her. But let’s be honest, with rising expenses, most parents wonder where to even start saving.

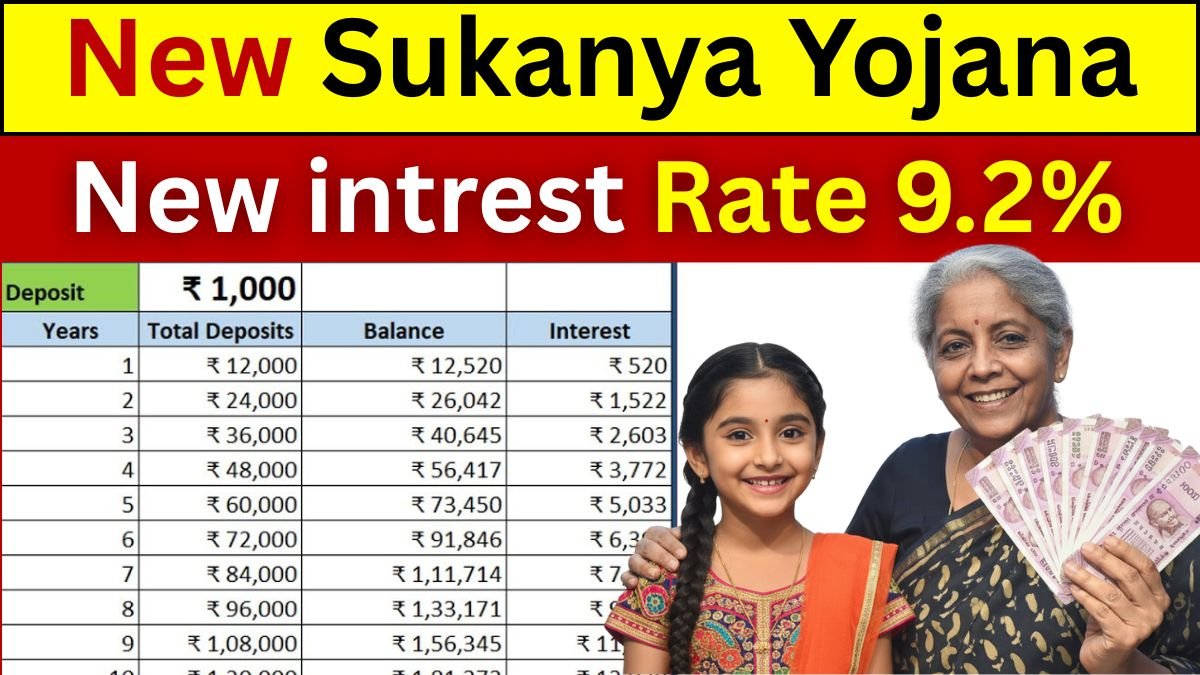

The truth is you don’t need a huge amount to begin. The government’s Sukanya Samriddhi Yojana (SSY) is a beautiful plan that turns small savings into a powerful future fund. Now imagine this if you simply save ₹12,000 a year that’s just ₹1,000 a month or about ₹250 a week this amount can grow into around ₹5,54,206 when the account matures. Sounds unbelievable, right? Let’s see how.

How the Scheme Works

Sukanya Samriddhi Yojana can be opened for a girl child under the age of 10. You can deposit any amount between ₹250 and ₹1.5 lakh in a financial year. The deposit period is 15 years, but the account continues to earn interest for 21 years in total. Currently, the government offers an interest rate of 8.2% per annum (compounded yearly) one of the highest among small savings schemes. And yes, both the interest earned and the maturity amount are completely tax-free.

Read more: Deposit ₹15k and Get ₹10,70,492 Return After 5 Years – Post Office RD Scheme

Real Calculation of ₹12,000 Yearly Investment

| Yearly Deposit | Deposit Period | Interest Rate | Total Deposit | Maturity Value |

|---|---|---|---|---|

| ₹12,000 | 15 Years | 8.2% (Compounded Yearly) | ₹1,80,000 | ₹5,54,206 |

So, by saving just ₹1.8 lakh in total, you can gift your daughter nearly ₹5.54 lakh at maturity all without any market risk.

Why Parents Love This Scheme

This scheme is not just about money it’s about emotion, care, and long-term love. Every small deposit you make today is like adding a brick to the foundation of her future. Over the years, that little effort grows quietly into something big something that can pay for her college, help her start her dream, or support her during marriage. It’s amazing to think that just ₹250 a week the price of one evening snack can one day turn into a strong fund that supports your daughter’s dreams.

Conclusion

The Sukanya Samriddhi Yojana is one of the most meaningful ways to save for your daughter’s future. With just ₹12,000 a year, you can build a secure and tax-free fund of ₹5,54,206. It’s safe, government-backed, and gives you peace of mind knowing that when your daughter needs it most, her dreams won’t stop because of money.

Disclaimer

This article is for educational and general knowledge purposes only. Interest rates for Sukanya Samriddhi Yojana may change as per government notifications. Please confirm the latest details from official India Post or authorized bank sources before investing.