Bike Loan: Let’s be real buying a bike isn’t just a deal it’s a small dream. The first ride that wind on your face and that feeling of freedom it hits different. But yeah not everyone has enough saved to pay all at once. That’s where a bike loan helps. It’s like the bank says Go get your dream bike now pay slowly later. So, if you’re thinking of taking a ₹2 lakh bike loan, the main thing that comes to mind is how much will the EMI be every month? Let’s talk in plain words, no banking jargon.

What a Bike Loan Really Means

See, a bike loan is just money the bank gives you to buy your bike. You return it in monthly payments EMIs. These EMIs depend on how long you want to take to repay and what rate the bank gives you. Usually, for bike loans the interest rate stays somewhere between 9% and 13% a year. You can choose a short term (say 2 years) if you want to finish early, or stretch it up to 5 years if you want smaller EMIs. But remember, the longer you stretch, the more interest you’ll end up paying that’s how it works everywhere.

Read more: If You Save ₹38k for Your Child, You’ll Get ₹10,30,613 After Maturity – Post Office PPF Scheme

₹2 Lakh Loan Simple EMI Example

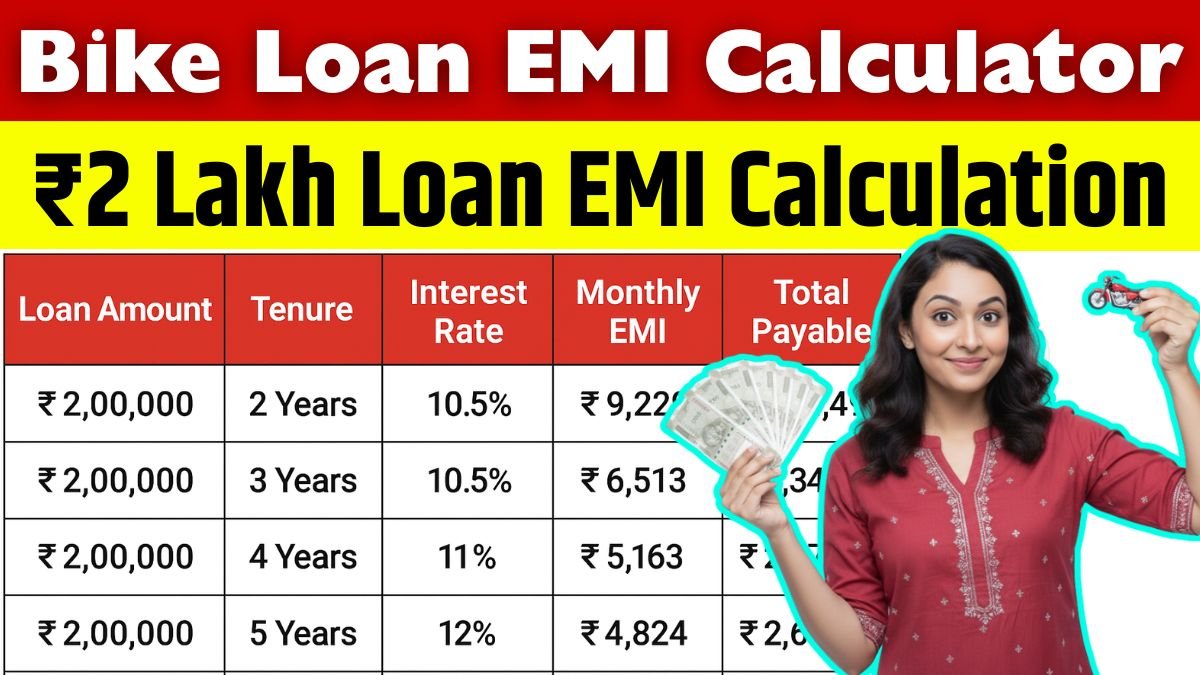

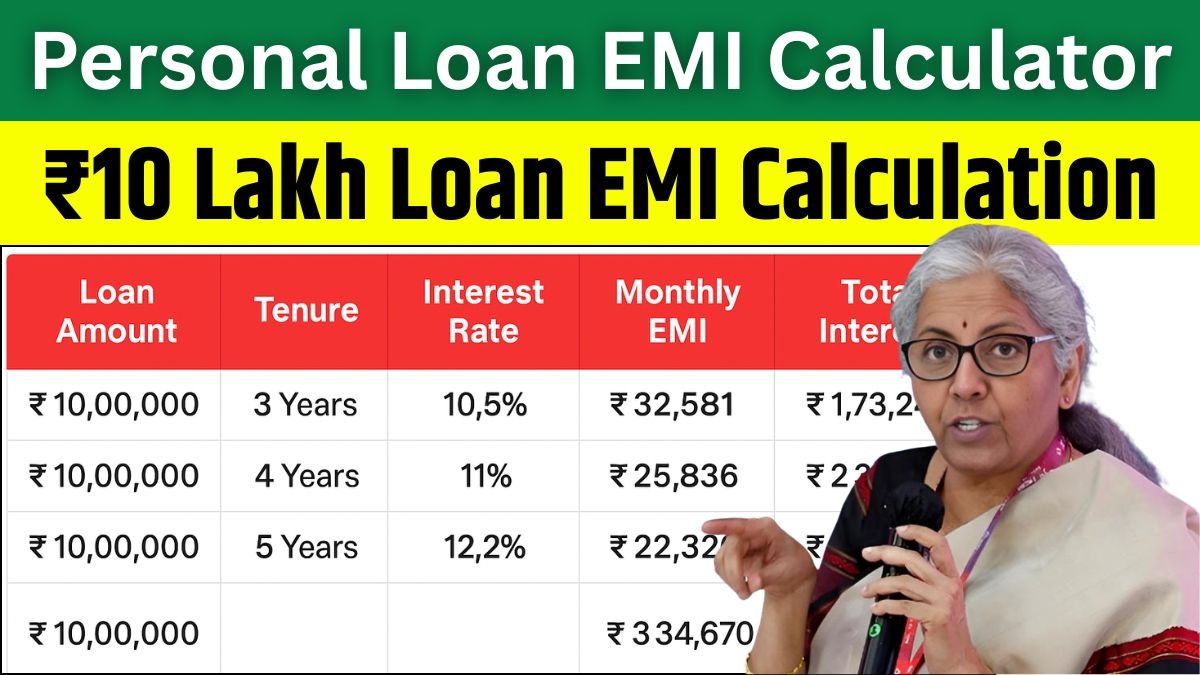

Let’s say you borrow ₹2 lakh for your new bike. Here’s roughly how your EMI looks under different time periods and interest rates

| Loan Amount | Tenure | Interest Rate | Monthly EMI | Total Interest | Total Payable |

|---|---|---|---|---|---|

| ₹2,00,000 | 2 Years | 10% | ₹9,229 | ₹21,496 | ₹2,21,496 |

| ₹2,00,000 | 3 Years | 10.5% | ₹6,513 | ₹34,468 | ₹2,34,468 |

| ₹2,00,000 | 4 Years | 11% | ₹5,163 | ₹47,824 | ₹2,47,824 |

| ₹2,00,000 | 5 Years | 12% | ₹4,449 | ₹66,940 | ₹2,66,940 |

So, for example, if you take a 3-year loan at around 10.5% interest, you’ll pay close to ₹6,500 per month. That’s easy to handle if you’ve got a steady income.

Why Bike Loans Make Sense Today

Honestly, getting a bike loan isn’t a headache anymore. Most banks approve them quickly if your CIBIL score is good say above 700. You don’t even need heavy documents or guarantors. The best part? You don’t have to wait for years to save up. You ride now, pay later simple. And if you repay your EMIs on time, your credit score gets stronger. That helps when you apply for bigger loans later, like a car or a home loan. Banks like SBI, HDFC, Axis Bank, and Bajaj Finance are known for quick approvals and good service.

Conclusion

If you’ve been dreaming of a new bike but didn’t want to empty your savings, a bike loan is a smart move. For a loan of ₹2 lakh, your EMI will usually fall between ₹4,400 and ₹9,200, depending on how long you choose to repay. Pick what fits your pocket, stay disciplined, and just enjoy the ride.

Disclaimer

This article is for educational and general awareness only. Interest rates and EMI details may change based on your income, bank policies, and credit score. Always confirm the latest information from official bank sources before applying.