Post Office PPF Scheme: Every parent dreams of building a secure future for their child something that will help them study well, live better, and stand strong tomorrow. But dreams need a plan. And when it comes to safe, guaranteed savings, the Post Office PPF Scheme has always been one of the most trusted options in India. Now, here’s something interesting if you invest just ₹38,000 per year in the PPF account of your child, it can grow into nearly ₹10,30,613 after a few years. Let’s understand how this happens and why this small, steady saving can become such a powerful support for your child’s future.

Why PPF Is a Smart Choice for Parents

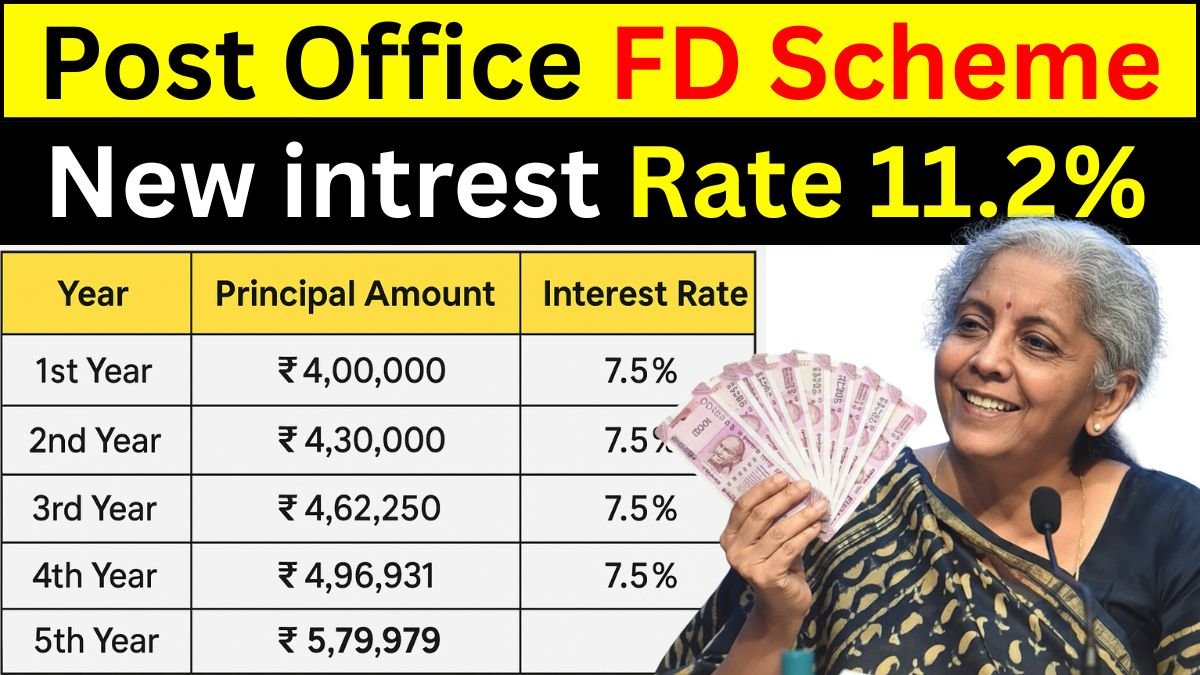

PPF, or the Public Provident Fund, is not a new scheme it’s been helping millions of Indian families save securely for decades. It’s backed by the government, which means your money is fully safe, and the returns are guaranteed. Right now, the interest rate is 7.1% per annum, and the interest is compounded yearly. The lock-in period is 15 years, but you can extend it if you wish. The best part? The returns and interest are tax-free under Section 80C so whatever you earn, you keep completely. It’s the kind of plan that doesn’t just give returns it gives peace of mind.

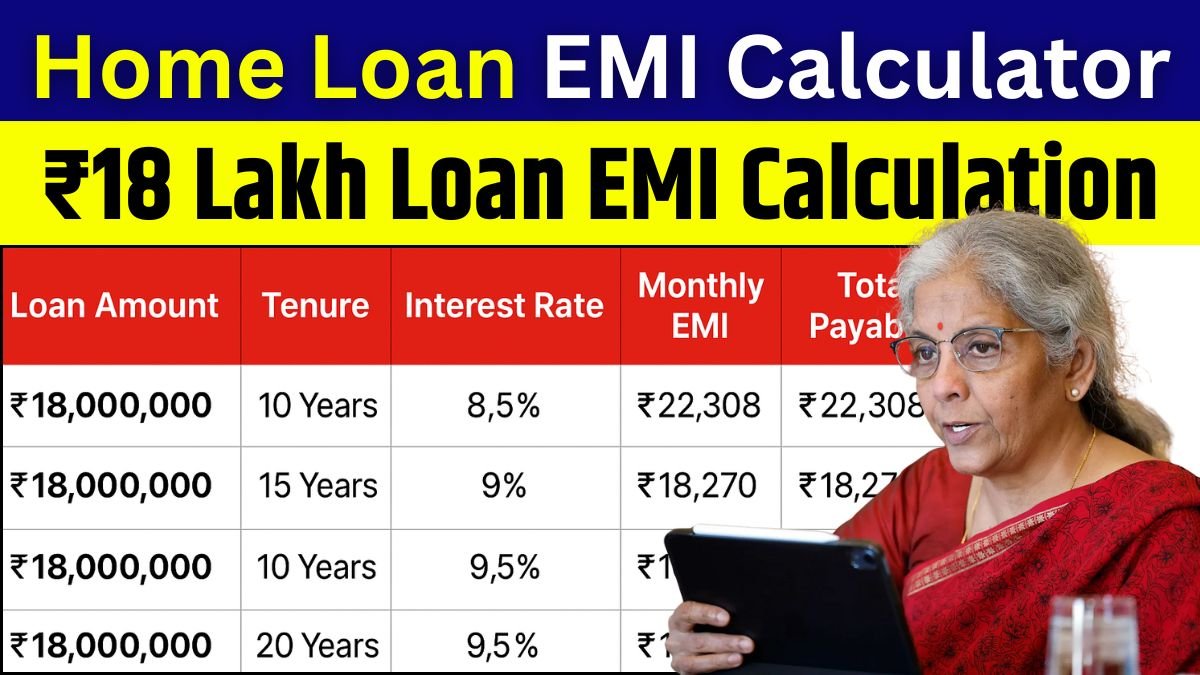

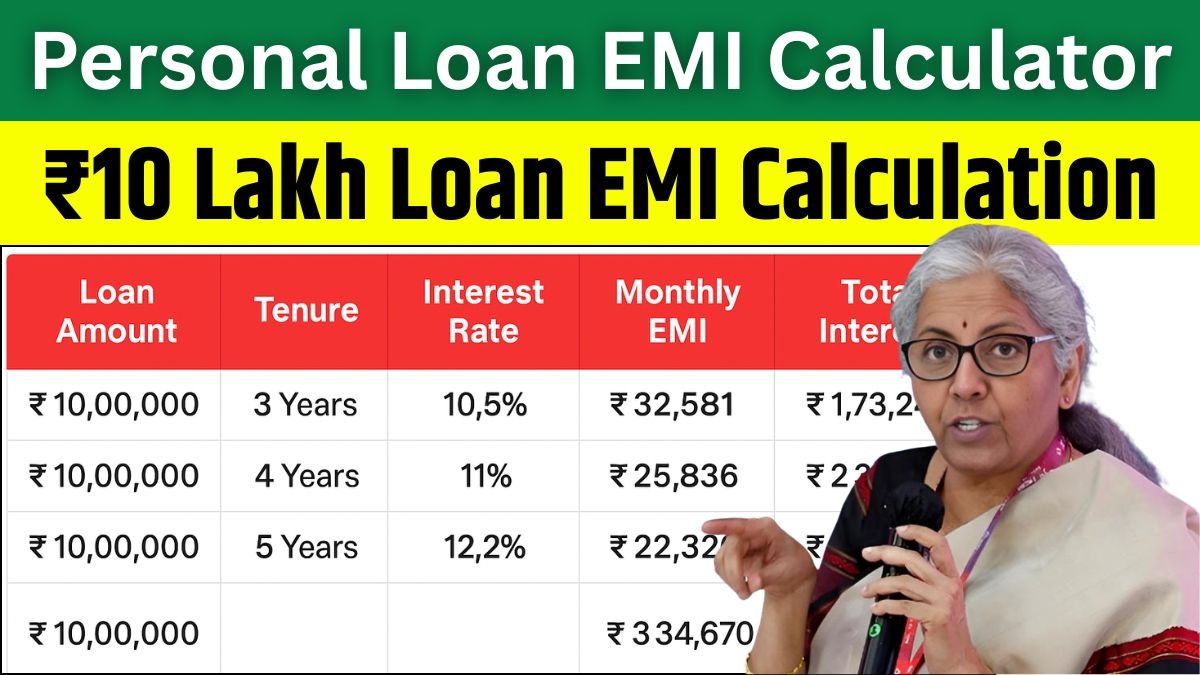

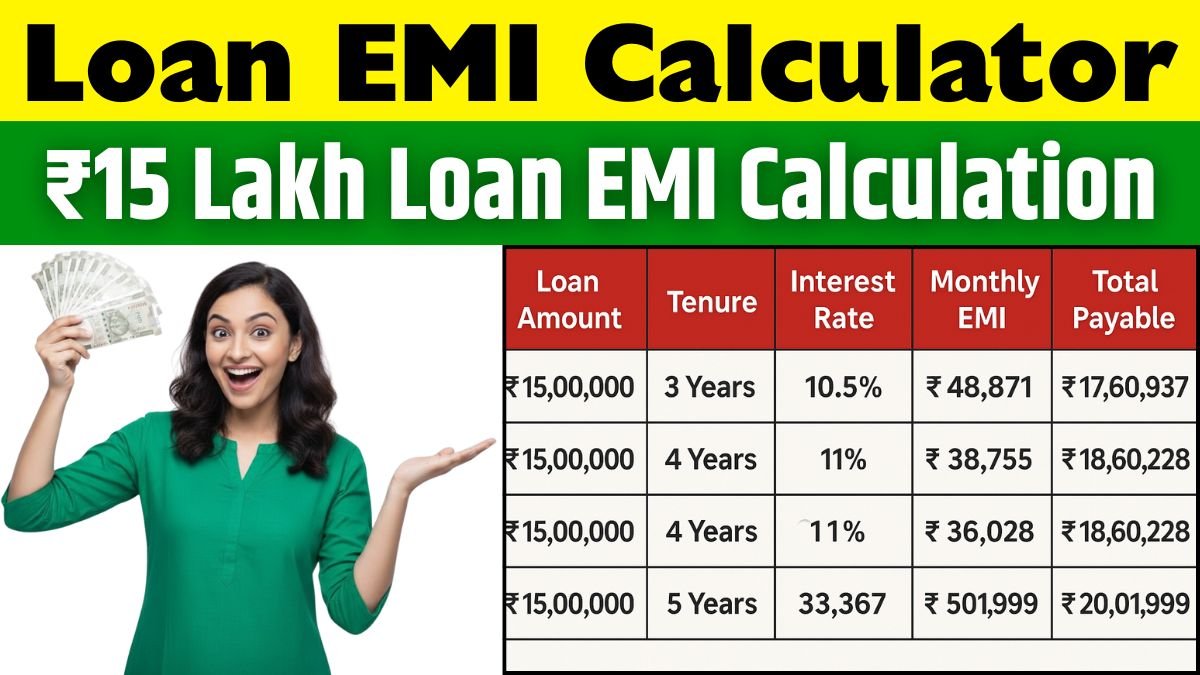

Read more: EMI Calculation for ₹10 Lakh Personal Loan with Interest Details

₹38,000 Yearly Deposit Full Calculation

Here’s how your savings of ₹38,000 per year can grow under the 7.1% interest rate in 15 years

| Yearly Deposit | Tenure | Interest Rate | Total Deposited | Maturity Value |

|---|---|---|---|---|

| ₹38,000 | 15 Years | 7.1% (Compounded Yearly) | ₹5,70,000 | ₹10,30,613 |

So, by simply investing ₹38,000 every year, you’ll deposit ₹5.7 lakh in total and your money will grow to ₹10.30 lakh, thanks to the power of compounding interest.

Why PPF Works So Well for Long-Term Goals

Unlike short-term deposits, PPF is designed for future needs the kind that require patience and discipline. Parents often open PPF accounts in their child’s name to secure money for higher education, marriage, or future goals.

It’s not about fast profits it’s about slow, steady, and safe growth. You don’t need to worry about market crashes or risks your money quietly grows in the background year after year. And the longer you keep it, the more compounding rewards you get. That’s why starting early even with small amounts makes a huge difference.

Conclusion

If you want to build a strong and safe financial base for your child, the Post Office PPF Scheme is one of the best options. A small yearly saving of ₹38,000 can turn into ₹10,30,613 in 15 years — tax-free and fully secured. It’s a simple habit that turns into a meaningful gift for your child’s future.

Disclaimer

This article is only for educational and general knowledge purposes. PPF interest rates may change based on government updates. Always verify the latest details from official India Post sources or your nearest post office before investing.