Personal Loan: There are times when life doesn’t wait your sister’s wedding, a health emergency, or maybe that long-delayed plan to start your own business. And when savings aren’t enough, a personal loan often becomes the quickest way to handle things without disturbing your peace of mind. Now if you’re planning to borrow ₹20 lakh, the first question that pops up is how much will I have to pay every month? Let’s talk about that in the simplest way possible.

What Exactly Is a Personal Loan

A personal loan is like borrowing money on trust. You don’t need to give your property papers or gold to the bank. It’s unsecured, which means the approval depends mostly on your income, CIBIL score, and repayment history.

Right now, most banks in India offer personal loans at interest rates between 10.5% and 15% per year, and you can choose to repay it in 1 to 5 years. Shorter tenures mean higher EMIs but less total interest. Longer tenures make the EMIs easier to handle, but you end up paying more interest overall.

Read more: Earn ₹9,240 Every Month with This Simple Investment – Post Office MIS Scheme

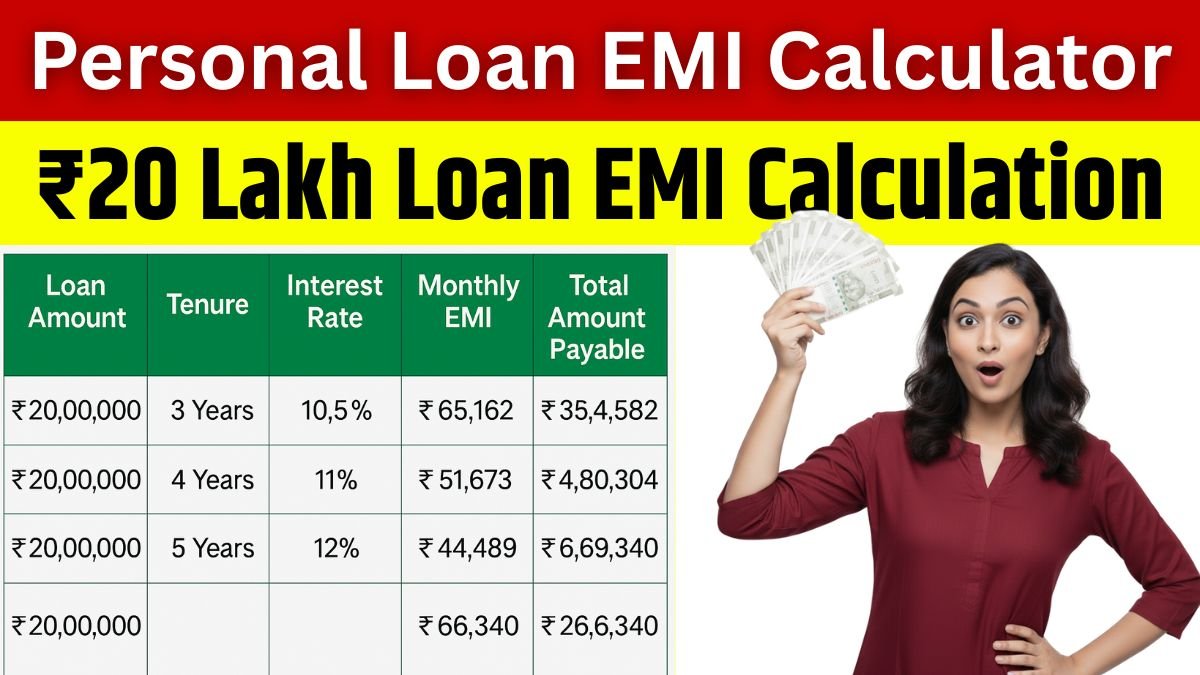

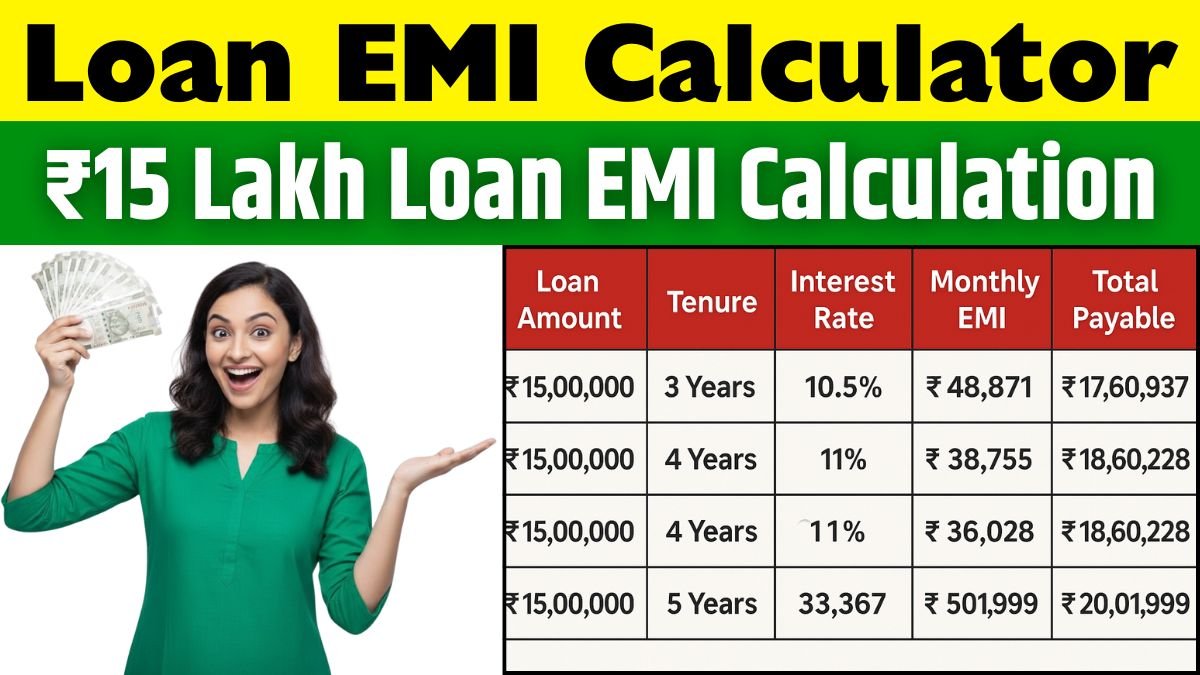

₹20 Lakh Loan EMI Calculation

| Loan Amount | Tenure | Interest Rate | Monthly EMI | Total Interest | Total Amount Payable |

|---|---|---|---|---|---|

| ₹20,00,000 | 3 Years | 10.5% | ₹65,162 | ₹3,45,832 | ₹23,45,832 |

| ₹20,00,000 | 4 Years | 11% | ₹51,673 | ₹4,80,304 | ₹24,80,304 |

| ₹20,00,000 | 5 Years | 12% | ₹44,489 | ₹6,69,340 | ₹26,69,340 |

If you pick a 5-year term, your EMI stays around ₹44,489, but you’ll pay more interest overall.

If you go for 3 years, the EMI is higher ₹65,162 but you save a good amount on total interest. It’s all about choosing what fits your monthly budget comfortably.

Why Your CIBIL Score Matters

Your CIBIL score works like your trust report. If it’s above 750, banks see you as a reliable borrower and may offer lower interest rates. A weaker score means higher rates or smaller loan amounts. It’s simple just like how a friend is more likely to lend you money if you’ve always returned it on time, banks do the same.

Conclusion

A personal loan can be a real helping hand when used smartly. For a ₹20 lakh loan, your EMI can range between ₹44,000 and ₹65,000 depending on the interest and tenure. Always compare offers, check your CIBIL score, and choose a repayment plan that doesn’t strain your monthly life. When handled wisely, a loan doesn’t create stress — it creates stability.

Disclaimer

This article is only for educational and general knowledge purposes. Loan interest rates and EMI amounts vary from bank to bank and may change over time. Please verify the latest details from official sources or speak to your bank before taking any financial decision.